Reducing Emissions and Raising Value Through Indonesia’s Carbon Trading

Indonesia’s carbon emissions are estimated to reach about 1.4 billion tons of CO₂e[1] annually, with fossil fuels contributing around 50% in 2023 (Global Carbon Budget & Bloomberg, 2025). Despite these challenges, the Ministry of Energy and Mineral Resources reported a record GHG emissions reduction of 147.6 million tons in 2024.

To achieve its 2030 target of 32% emissions reduction (or 43% with international support) compared to a business-as-usual[2] scenario, Indonesia has introduced a carbon trading mechanism. This initiative treats CO₂ emissions as tradable commodities, enabling monetization through market incentives and simultaneously empower industry to act more sustainably. With a potential market value of IDR 8,000 trillion, Indonesia holds a strategic role in the global carbon market (KataData Insight Center, 2022).

Carbon Trading Mechanisms in Indonesia

Carbon trading is a market-based mechanism that reduces greenhouse gas emissions by offering economic incentives through carbon credit or allowance trading. Governed by Presidential Regulation 98/2021 and MoEF[3] Regulation 21/2022, Indonesia’s system comprises two main schemes:

- Emissions Trading Scheme (ETS) / Cap-and-Trade

The emissions trading scheme applies to the mandatory carbon market, where the government allocates emission quotas to entities. These entities are required to maintain emissions within the allocated quotas and those exceeding their limits must buy carbon credits, encouraging emissions control and market balancing.

2. Carbon Credit Trading Scheme / Carbon Offset

This scheme applies to both voluntary and mandatory markets. It uses Greenhouse Gas Emission Reduction Certificates (Sertifikat Pengurangan Emisi Gas Rumah Kaca, SPE-GRK) as carbon credits, which are issued to verified emission reduction projects. Businesses seeking to offset their emissions may purchase these credits from emission reduction initiatives.

These mechanisms operate within an ecosystem known as the carbon market, which assigns market value to carbon and turns it into a tradable economic asset. In this market, carbon credits act as intangible securities that can be transferred and traded, similar to stocks or bonds, as stipulated in the Financial Services Authority Regulation (POJK) 14/2023.

The Development of Indonesia’s Carbon Market

To facilitate carbon trading, Indonesia officially launched its national carbon market on 26 September 2023 through IDXCarbon, a platform under the Indonesia Stock Exchange. The KESDM[4] has designated a three-phase rollout for the carbon market, which is currently focused on the power sector:

- Phase 1 (2023–2024): Targeted 146 on grid coal-fired power plants (CFPP), with a combined emissions cap of 256.8 MtCO₂e.

- Phase 2 (2025–2027): Expanding to include off-grid CFPPs >25 MW, as well as gas-fired, gas engine, and combined-cycle power plants connected to the PLN grid.

- Phase 3 (2028–2030): Covers all fossil-fuel-based power plants, including diesel and small-scale CFPPs.

In addition, the KLH[5] has also announced their plans to implement emission caps for the forestry, industry, agriculture, and waste sectors, showing stronger national commitment to proactively involved in global climate mitigation efforts.

Entering the second phase in June 2025, the carbon market recorded a trading volume of 691,304 tons of CO₂e, valued at IDR 27 billion since January 2025. IDXCarbon also facilitated Indonesia’s first international carbon trade, with eight SPE-GRK projects officially registered. This phase marks a critical period of transition and acceleration aimed at expanding participation in both domestic and international carbon markets.

Future Outlook of Indonesia’s Carbon Market

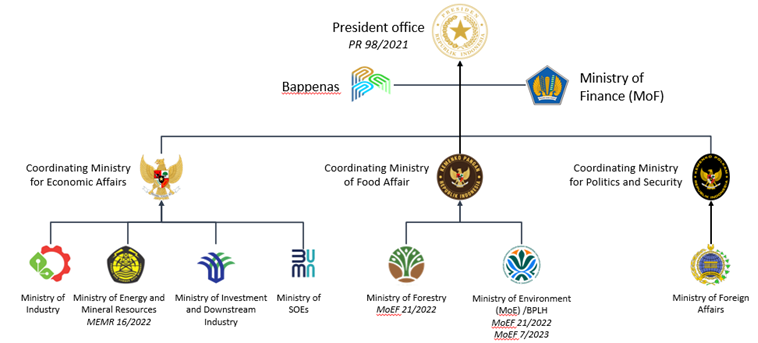

Indonesia’s domestic and international carbon markets hold significant potential to advance the country’s decarbonization goals and finance national economic growth. To strengthen this ecosystem, the government requires to strengthen its regulatory framework for carbon trading, given to the complex bureaucracy appears due to various ministries direct involvements (Figure 1).

Therefore, strengthening regulatory framework by establishing a coordination body for carbon economy will be vital. This body can fortify the cross-ministries alignment, also monitoring carbon economy transparency and credibility by assuring standardized measurement, reporting, and verification (MRV) methodologies and internationally recognized carbon credit standard. In May 2025, Indonesia formalized an agreement with Gold Standard, while further agreements with Verra will be followed soon. Additionally, Indonesia should target more international cooperation to expand market access. A substantial Mutual Recognition Arrangement with Japan in 2024 via Joint Crediting Mechanism should be followed by exploring and targeting next strategic partners including Norway, South Korea, and Denmark, as the agreement is currently under preparation, claimed by Minister of Environmental Affairs.

[1] Carbon dioxide equivalent

[2] A projection of GHG emissions assuming no new climate policies or actions are taken beyond current measures

[3] Ministry of Environmental and Forestry

[4] Kementerian Energi dan Sumber Daya Mineral (Ministry of Energy and Mineral Resources)

[5] Kementerian Lingkungan Hidup (Ministry of Environmental Affairs)